Sticker Company Prepared An Aging Of Accounts Receivable

Understanding the Accounts Receivable Aging Report. Aging the accounts receivables is a process under which a report is prepared for unpaid customers and the said report is used by the collections officer of the company to track the invoices which are overdue for payments and to take necessary actions for the timely recoverability of revenue of the organization.

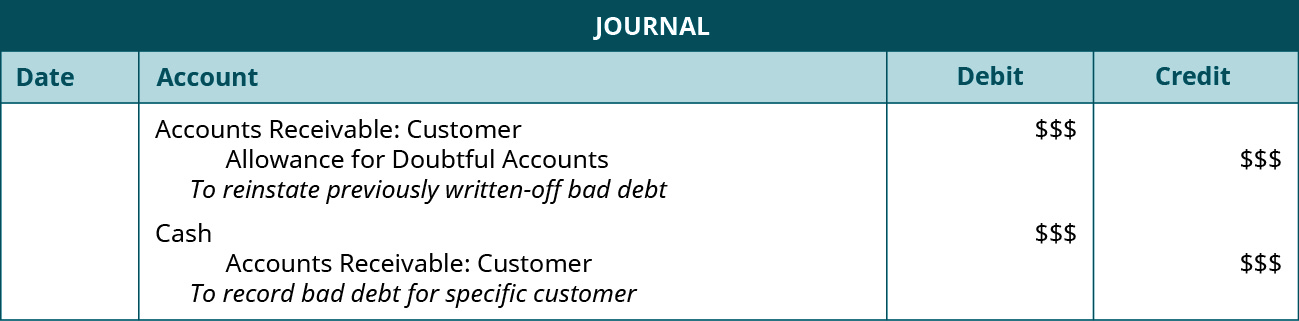

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

The reconciliation of accounts receivable is the process of matching the detailed amounts of unpaid customer billings to the accounts receivable total stated in the general ledgerThis matching process is important because it proves that the general ledger figure for receivables is justified.

Sticker company prepared an aging of accounts receivable. Based on this information the company should have an allowance for doubtful accounts of 22500 which is calculated as. When employees follow the company collections policy there are no gray areas. Accounts payable is a collection of current liabilities a company is required to pay see accounts payable job description.

This report directs managements attention to accounts that are slow to pay. Any customer debts listed in the report are considered. The AR Aging Report and Your Business An account receivable aging report helps you understand what kinds of outstanding payments are due to your business.

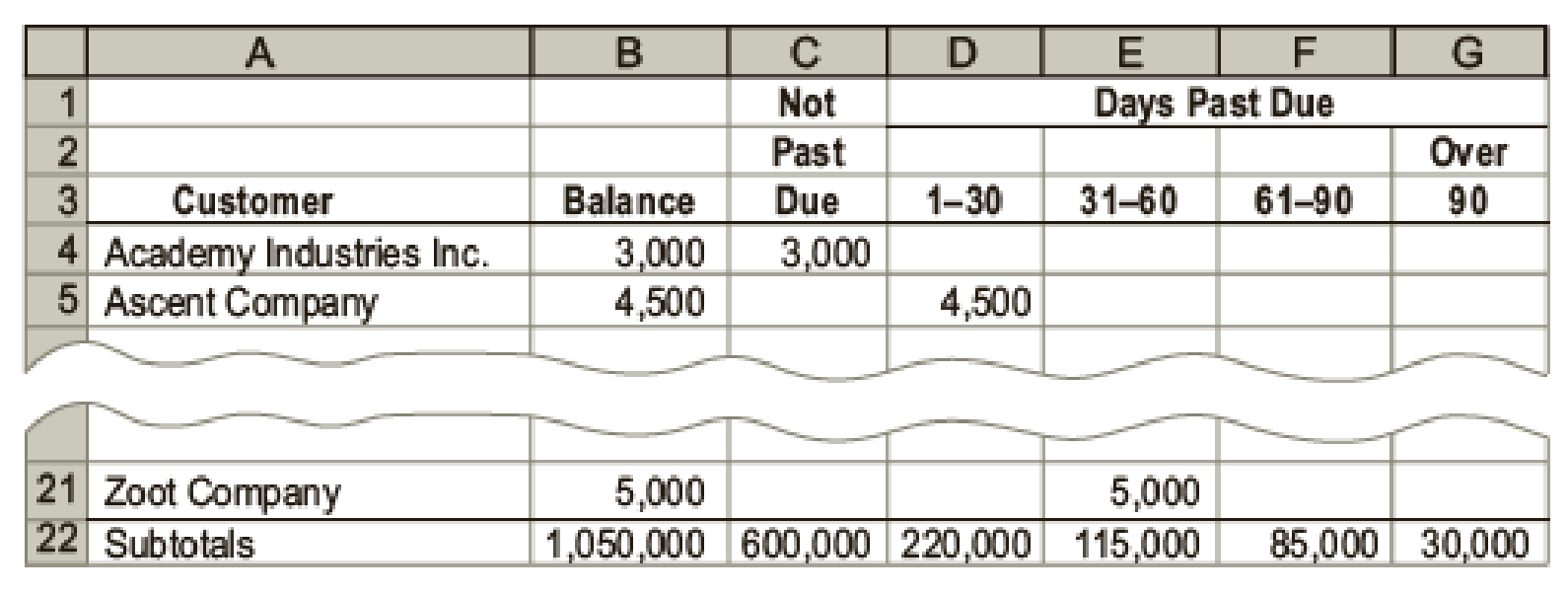

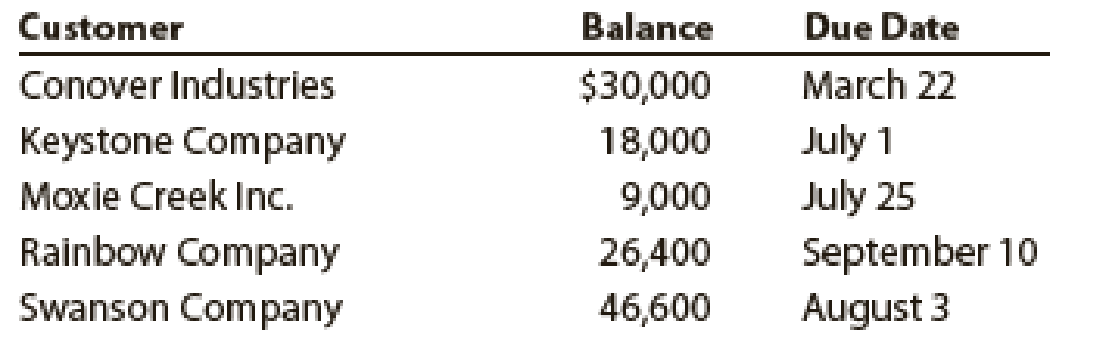

Heres an example of the accounts aging report. It creates more consistent systematic treatment that aligns with corporate goals and business procedures and that level of consistency makes it easier to implement automation strategies. The detailed information in the accounts receivable subsidiary ledger is used to prepare a report known as the aging of accounts receivable.

They are typically broken down in such a way that you can review all accounts that are due and past due seeing which accounts are 30 days late 60 days late or 90 days late. An AR aging report categorizes how much money is owed from every customer on record credit memos and how long each invoice has been active. Accounts receivable aging is the process of distinguishing open accounts receivables based on the length of time an invoice has been outstanding.

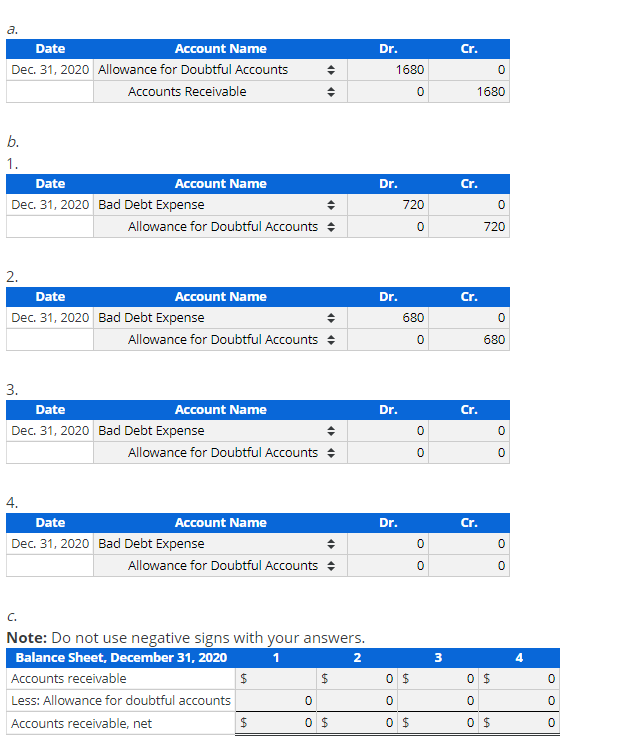

18 Create a formula for each age category using the Excel IF and AND FUNCTIONS Ex to determine where each customer amount belongs. Accounts receivable aging sometimes called accounts receivable reconciliation is the process of categorizing all the amounts owed by all your customers including the length of time the amounts have been outstanding and unpaid. It is also useful in determining the balance amount needed in the account Allowance for Doubtful Accounts.

19 The IF statement may include the following arguments. AR professionals handle the billing of customers and the monitoring and collection of those bills in a timely fashion. If Allowance for Doubtful Accounts has a 2000 debit balance the adjustment to record bad debts for.

Prepared an aging of its accounts receivable at December 31 2019 and determined that the net realizable value of the receivables was 300000. The two information sources for this reconciliation are as follows. It indicates the total accounts receivable balance that have been outstanding for specified periods of time.

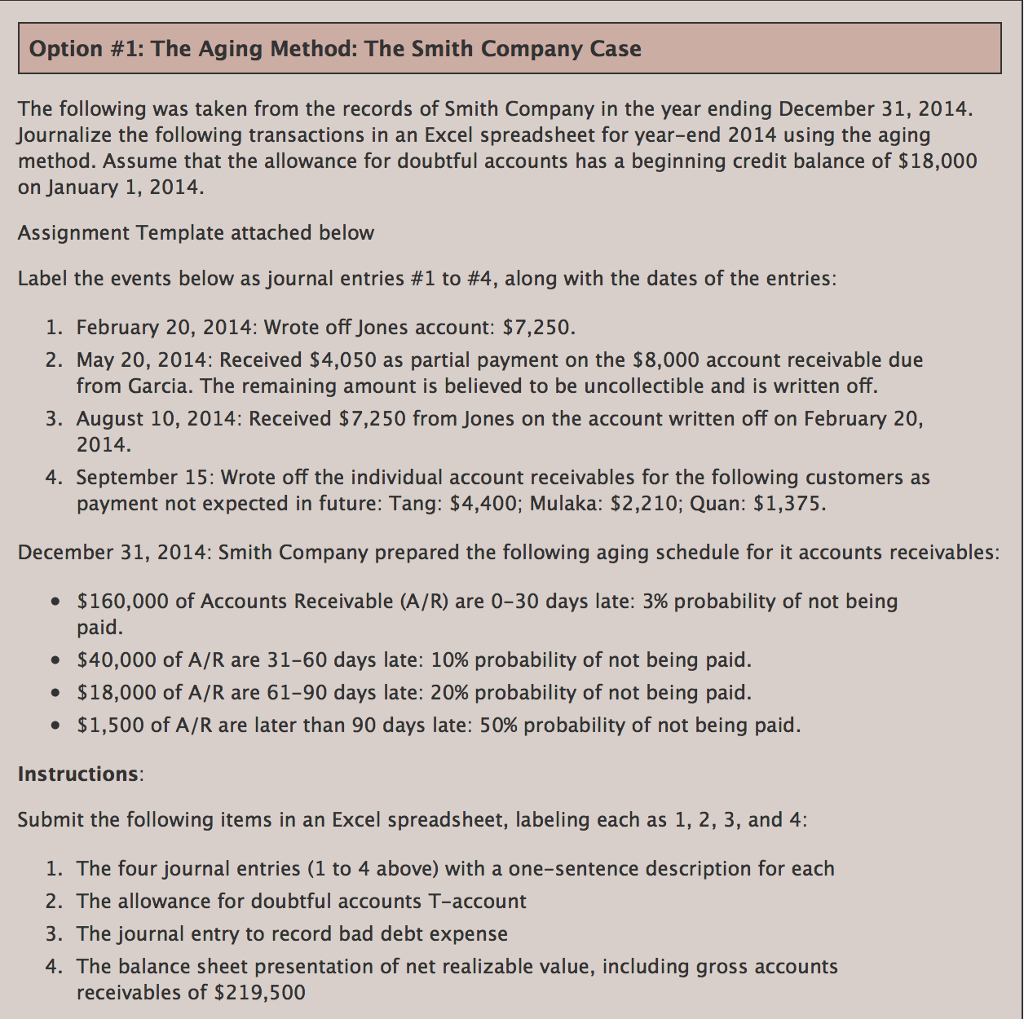

500000 x 1 200000 x 5 50000 x 15 22500. Youre aging this information. An aging of a companys accounts receivable indicates that 6000 are estimated to be uncollectible.

Accounts receivable is a collection of current assets a company has a right to collect. Additional information is available as follows. This is used for determining which of its clients are paying on time and may also be utilized for cash flow estimation.

Create a formula for each oratory using the wrel IF and AND FUNCTIONS to determine where anch 17 2 Use the information above to complete the Aging of Accounts Receivable Schedule below. The aging schedule lists accounts receivable that are less than 30 days old less than 45 days old or moreless than 90 days old. Allowance for uncollectible accounts at 1119credit balance 34000 Accounts written off as uncollectible during 2019 23000.

The age of your outstanding balances Its a simple financial report that comes standard with most accounting software packages. That govern the accounts receivable teams procedures. Its most recent accounts receivable aging report contains 500000 in the 30 day time bucket 200000 in the 31-60 day time bucket and 50000 in the 61 day time bucket.

Accounts receivable aging is useful in determining. The aging report is used to collect debts and establish credit. Accounts Receivable Aging Report.

Acct101 Ch 8 Homework Flashcards Quizlet

Accounting Homework Help Homeworkcrew

Solved At December 31 2020 Its Annual Year End The Acc Chegg Com

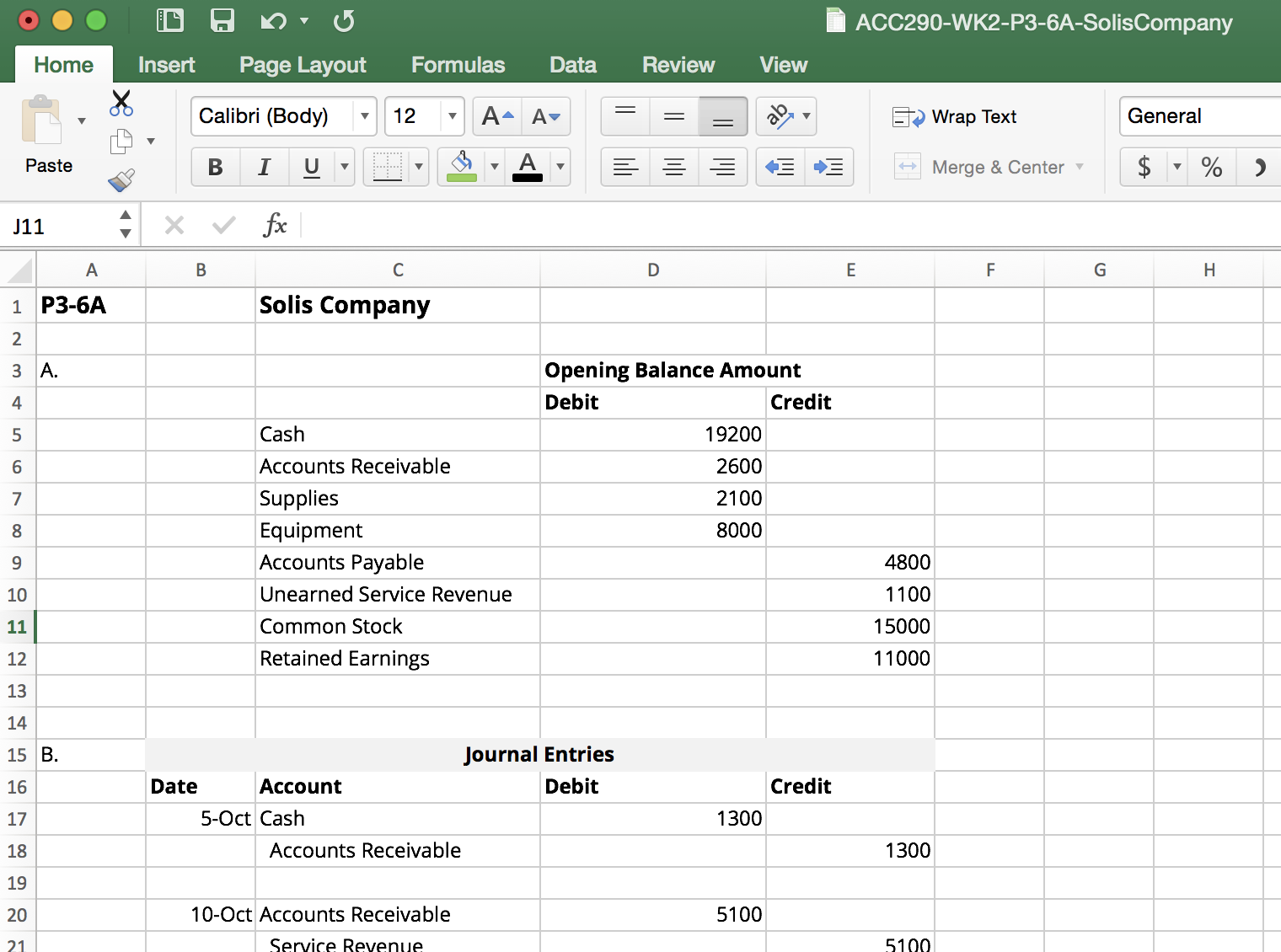

How To Solve P3 6a Solis Company Campushippo

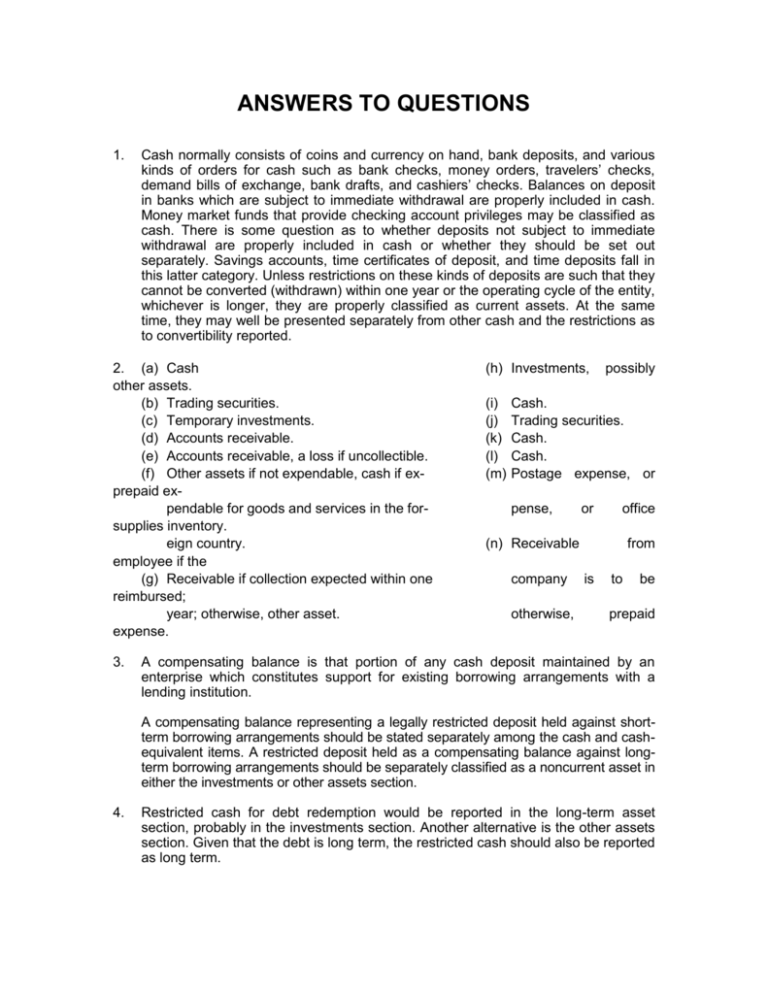

Intermediate Acc I Final Exam 2 Ch7 Cash And Receivable Flashcards Quizlet

P1 12 Estimated Doubtful Accounts 105 Lailanie Cuasito Chapter 12 Estimation Of Doubtful Accounts Problem 12 1 Aicpa Adapted Orr Company Prepared An Course Hero

Financial Accounting Chapter 7 Flashcards Quizlet

Intermediate Acc I Final Exam 2 Ch7 Cash And Receivable Flashcards Quizlet

Solved Option 1 The Aging Method The Smith Company Cas Chegg Com

Accounts Receivable Aging Report Accounts Receivable Accounting Report Template

Acct101 Ch 8 Homework Flashcards Quizlet

The Accounts Receivable Clerk For Kirchhoff Industries Prepared The Following Partially Completed Aging Of Receivables Schedule As Of The End Of Business On August 31 The Following Accounts Were Unintentionally Omitted From

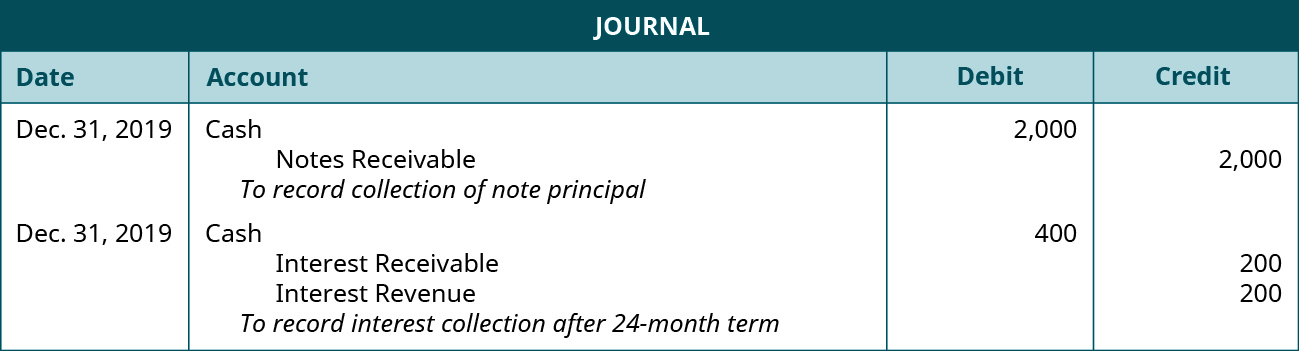

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

Best Income Statement For Manufacturing Company Template Pdf Sample In 2021 Income Statement Cash Flow Statement Business Plan Template

Accounting Homework Help Homeworkcrew

P1 12 Estimated Doubtful Accounts 105 Lailanie Cuasito Chapter 12 Estimation Of Doubtful Accounts Problem 12 1 Aicpa Adapted Orr Company Prepared An Course Hero

The Accounts Receivable Clerk For Kirchhoff Industries Prepared The Following Partially Completed Aging Of Receivables Schedule As Of The End Of Business On August 31 The Following Accounts Were Unintentionally Omitted From

Post a Comment for "Sticker Company Prepared An Aging Of Accounts Receivable"